WHY MULTIFAMILY

Multifamily Real Estate

A basic human need

Apartments address the basic human need for "a roof over our head". Whether the economy is going up or down, people need a place to live. During the last housing crisis, multifamily investments had a default rate of .02% compared to single family homes at 6%.

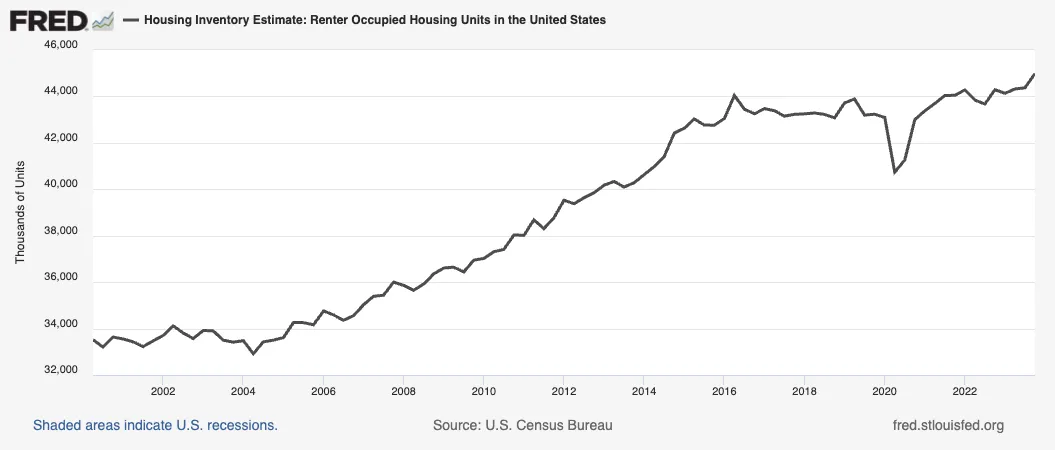

Not to mention that demand for apartments is at an all-time high, population is continuing to increase which drives the demand for apartment living higher and higher. Low vacancy rates equals greater cashflow as well as equity growth, which translates to higher returns for our investors.

Demand for apartments is at an all-time high and still climbing

Apartments have historically outperformed stocks & bonds

Multifamily investments have historically out performed other real estate classes

BENEFITS OF INVESTING IN MULTIFAMILY ASSETS

TAX ADVANTAGED INCOME

Investors utilizing leverage depreciation, cost-segregation and Section 1031 exchanges can defer taxation on much of their real estate income into perpetuity.

HEDGE AGAINST INFLATION

Multifamily property values have proven to be virtually a perfect inflation hedge - .98 correlation since 1978 when reliable data became available.

HEDGE AGAINST RECESSION

JP Morgan looked at the worst five-year periods for various investments from 1977-2012 and calculated total return (including cash flow). $100 invested in apartments at the beginning of the worst five-year period for real estate was worth $110 at the end. A portfolio of 60% stocks/40% bonds was worth $94 at the end of its worst five years.

SUPERIOR RISK-ADJUSTED RETURNS

For decades, multifamily has exhibited the least volatility and highest risk-adjusted returns of all real estate asset classes. This long-term performance along with tax and hedging benefits has been amplified in the short term.

BENEFITS OF INVESTING IN MULTIFAMILY ASSETS

TAX ADVANTAGED INCOME

Investors utilizing leverage depreciation, cost-segregation and Section 1031 exchanges can defer taxation on much of their real estate income into perpetuity.

HEDGE AGAINST INFLATION

Multifamily property values have proven to be virtually a perfect inflation hedge - .98 correlation since 1978 when reliable data became available.

HEDGE AGAINST RECESSION

JP Morgan looked at the worst five-year periods for various investments from 1977-2012 and calculated total return (including cash flow). $100 invested in apartments at the beginning of the worst five-year period for real estate was worth $110 at the end. A portfolio of 60% stocks/40% bonds was worth $94 at the end of its worst five years.

SUPERIOR RISK-ADJUSTED RETURNS

For decades, multifamily has exhibited the least volatility and highest risk-adjusted returns of all real estate asset classes. This long-term performance along with tax and hedging benefits has been amplified in the short term.

Learn How To Become An Investor With Us

We welcome inquiries from investors seeking multifamily investment opportunities.

©2026 Penningar Capital . All Rights Reserved.

©2026 Penningar Capital . All Rights Reserved.

No Offer of Securities—Disclosure of Interests

Under no circumstances should any material at this site be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the Confidential Private Offering Memorandum relating to the particular investment. Access to information about the investments are limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments.